Requirements

-

MetaTrader 5 broker

-

Netting or hedging account

-

Leverage 1:100

-

Minimum capital $10000

-

EURCAD, EURJPY, GBPAUD,

-

GBPCHF, GBPJPY, GBPUSD, USDCAD, NZDUSD

-

Telegram account

-

FIFO compliant

-

Public demo on Myfxbook

EVIL TWINS [SYSTEM]

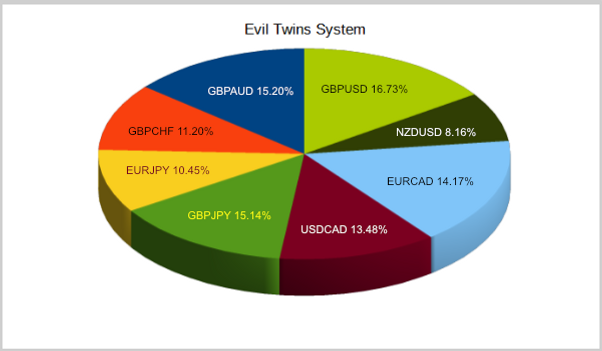

Evil Twins is our full featured trading system included with the Premium Plan. It is equipped with eight symbols (3 majors and 5 cross rates). The strategy algorithms and selected symbols create an all weather system intended to keep you in the market and able to withstand turbulent conditions. Evil Twins is our workhorse trading system which can be broken in to custom currency groupings for competitive trading or low margin restrictions. Our Linear Quest system is such a sub grouping. The software which drives this system incorporates both range and trend follow algorithms so as to be able to perform during transitioning market conditions. The behavior of the system can be further customized by applying advanced features such as Martingale, DCA, Instant Hedging or Anti-Martingale. Configuration is administered from the convenience of your invite only Telegram channel. Our design goals were to create a FIFO compliant nonhedging system that didn’t rely on scalping or spread trading as the primary profit mechanism. As a result the Evil Twins system can accommodate MT5 brokers from any jurisdiction including U.S. customers subject to Dodd-Frank legislation and restricted leverage. With all symbols enabled and configured as shown, our backtest results exhibit over 10,000 trades during the simulation period. In live trading the system is expected to produce 20 to 50 trades per week during the forex active months.

This is a cloud based system. No EA or download is necessary. You will need a MetaTrader 5 broker and a netting or hedging type account. To use Instant Hedging you will need a hedging type account from your broker. Please see our required CFTC statement regarding back test results here. Keep in mind that you should only trade what you can, realistically, afford to lose.

This premium system includes 8 currency instruments balanced to run simultaneously on a non-hedging account. No scalping or spread trading so compatible with most brokerages.

Backtest configuration used to generate results

-

System: Evil Twins

-

Years Tested: 2015-2023

-

Account Balance: $10000

-

Base Lot Size: 0.02 (micro)

-

Minimum Profit: 25 pips

-

Stop: Conditional

-

Leverage: 1:100

-

Netting: Yes

-

Martingale: Yes

-

Strategies: 8

-

Bar Interval: 5 and 15 minutes

-

Data Source: Dukascopy

Each currency can be run separately with commensurately lower capital and margin requirements.

Use our webapp forms to customize how this robot will trade your account.

All of our systems use a conditional exit and an internal profit threshold to close trades in the black. Your robot configuration form provides a way to extend the duration of profitable trades with the “Minimum Profit” field. This is a whole number value representing pips gain. To exit a trade earlier than the minimum threshold you can set a take profit limit. This will result in a limit order sent to your broker and thus appearing in the MT5 terminal. To set a hard stop sent to your broker add a stop offset. Both the limit and stop offsets are expressed as whole numbers indicating a pips quantity. The robot itself is actually a particular strategy associated with a specific currency pair. The configuration only applies to this single combination but each registered account can be configured uniquely. So for example: Evil Twins could be split across multiple accounts with three robots on one account and another three on another. Or the entire set could be duplicated with each account having completely different configurations. All of your configuration forms are accessible from your Telegram invite only channel. For more information see our “How It Works” page.

CFTC RULE 4.41 - Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under — or over — compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.